What is Forex Trading?

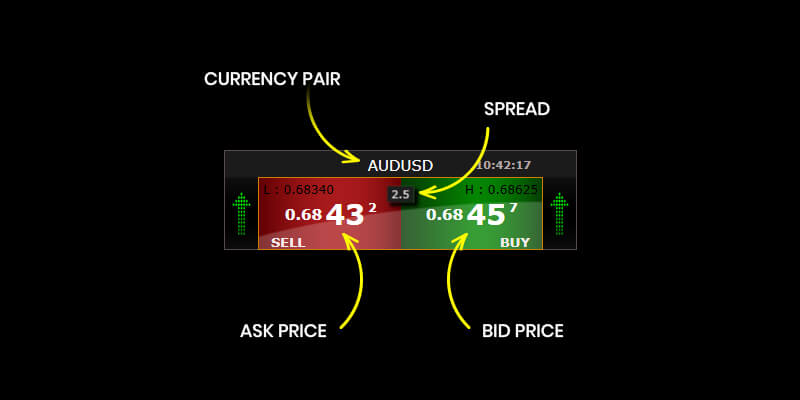

Forex trading, which stands for foreign exchange trading, is the conversion of one currency into another. It involves the simultaneous buying of one currency and selling of another. Forex trading takes place on the Forex Market where all participants buy and sell currencies; participants that include central and commercial banks, companies, hedge funds, brokers, and retail clients. In trading, you will be presented with 2 prices, the sell price and buy price. At any given moment, the sell price will always be lower than the buy price. For any person to make profit in the forex market there are only 2 ways: either the person takes a buy order and waits for the price to increase so he can sell back at a higher price, or he takes a sell order and waits for the buy price to decrease so he can buy back at a lower price. If you buy, the sell price must increase above the price at which you bought to make profit. If you sell, the buy price must decrease below the price at which you sold to make profit.

There are many terms in Forex trading that will sound unfamiliar to someone who is new, so here are 3 terms to start with before the more difficult terms.

- Market Liquidity

- Liquidity consists of two factors, the speed at which an asset can be sold, and the price at which that asset is sold. In a market with low liquidity, the asset will not be sold immediately after being put on the market and the price may have to be cut down for the sell to go through. For example, in a country where the real estate market is down, putting a house for sale may take a few months to sell, and the price at which it sells could be lower than the original listing price. In a market with high liquidity, the asset can be sold quickly, with little to no loss in price. Taking the same example, if the house was being sold in a high demand area, offers for the house may start coming in the same day it is listed for the same listed price.

- The Forex market has the highest liquidity in the world. This means that when a participant in the forex market buys or sells currency, the order is fulfilled instantly with almost no loss in price, and closing the position is also instant. This is possible because of the huge volume of orders taking place, with millions of buy and sell orders at any moment.

- Pips and Spread

- Before we talk about spread, lets define a more basic term: pips. A pip is the lowest amount of price movement in a currency. Spread is the difference between the buy (ask) price and the sell (bid) price, measured in pips.

- For example, at the time of writing this article, the ask (buy) price for USDCHF is 1.00129 and the bid (sell) price is 1.00118. 1 pip, in this case, is 0.00001; the spread is 11 pips. To make profit if you place a buy order, the sell price would have to increase by 12 pips to 1.00130, and you would make 1 pip of profit. To make profit on a sell order, the buy price would have to reduce by 12 pips to 1.00117.

- Taking another example, the ask price for USDJPY is 107.006 and the bid price is 107.008. 1 pip would be 0.001 and the spread is 2 pips. To make profit, the currency would have to move 3 pips in either direction depending on whether a buy order or sell order was initiated.

- Analysing the examples above, there are a few things to note about spread. Tighter spreads (spreads with only a small difference) require fewer currency movements to make profit, while larger spreads require more currency movements to make profit.

- Most broker companies offer variable spread, which means that the spread can change depending on market volume, news, and liquidity. A few broker companies offer fixed spread, which means the spread does not change no matter the market condition. In general, a variable spread is cheaper in a highly liquid currency when no major news has occurred, while fixed spreads offer fixed costs so that you know what to expect in spread.

- Lots, Leverage, and Margin

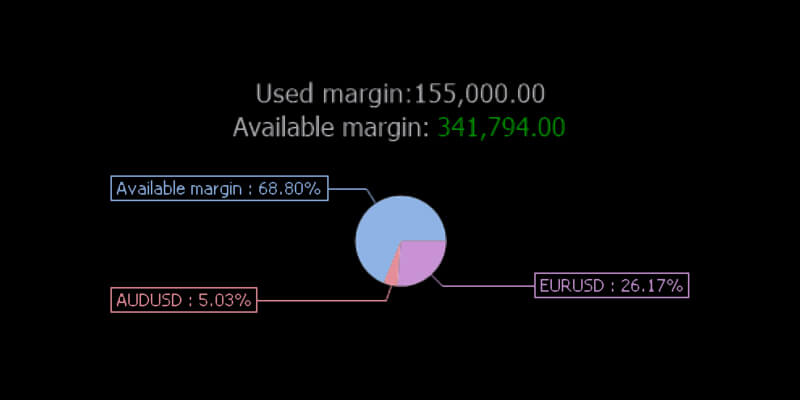

- A contract (lot) is the name of the order which is traded in buy or sell orders in forex. One Standard lot size contains 100,000 units of currency. There is also a Mini contract size of 10,000 units, a Micro of 1,000 units and a Nano of 100 units. We will talk only about Standard lots for our examples.

- Leverage and Margin are interconnected. If you were to buy a Standard lot with no leverage, you would have to pay 100,000$ for one standard lot. However, leverage allows you to pay much smaller amounts to buy or sell lots. A leverage is denoted by x:1 where x is the amount you divide the contract size by to find how much you pay to place an order.

- For example, a leverage of 100:1 is one of the most commonly offered leverage from many broker companies. At this leverage, a standard lot of 100,000 units would cost 1,000$ to get hold of instead of 100,000$. Margin is the amount that must be deposited to hold a leveraged position; your margin in the above example would be 1,000$.

- Leverage can come in many different amounts: from 5:1 all the way to 400:1. Leverage can vastly increase your profit, but can also greatly increase your loss.

- For example, buying one contract of EUR/USD with no leverage means you spent 100,000$. If the market moves 10 pip into profit, you’ve made 10 dollars with a 100,000$ investment. However, with a 100:1 leverage and the same scenario, you’ve made 10 dollars with a 1,000$ investment. 10 dollars is a bigger chunk of 1,000$ than it is of 100,000$ dollars which means leverage can provide more profit. With an actual investment of 100,000$ in a company that provides 100:1 leverage, you can take up to 100 leveraged standard lots, which provides massive opportunities to make money or to lose money.

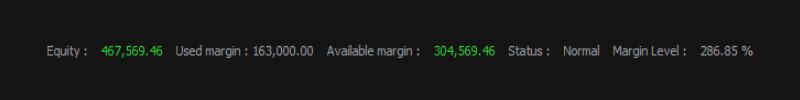

Image describes about 'How a typical margin statement looks like in a trading application'

Conclusion

For someone who is new to Forex trading, there is a lot to learn, not just about the trading but also about the industry, the history, the various terms that people use, market mentality and more. As we progress through these blog posts, we will cover more and more topics. Information is power, and you must arm yourself as well as you can before you jump into battle.